Introduction: Regulatory and Market Triggers for LOS Modernization

Legacy loan origination systems are under growing pressure from regulatory shifts, rising fraud risks, and ballooning operational costs. Section 1071 of Regulation B will soon force lenders to capture and report granular SME lending data, a mandate that essentially compels LOS upgrades.

Meanwhile, explainability for adverse action notices under ECOA/Reg B remains non-negotiable, even when using algorithmic underwriting. And with identity fraud losses in the U.S. nearing $23 billion in 2023, every dollar lost costs institutions approximately $4.36 in total fallout.

At the same time, origination costs are rising sharply, with reports stating a ~$3,000 increase per loan over three years, a 35 % spike, putting lenders under serious margin pressure.

Against this backdrop, modernizing LOS with Gen AI-assisted, parsable modernization (full stack transformation, strong testing, and compliance-first architecture) is emerging as the quickest and safest viable path for risk-conscious financial institutions.

This blog explores the key pressure points and how a parity-first modernization strategy can address them head-on.

Where Loan Origination Still Runs on Legacy Stacks

Despite heavy digitization efforts on the customer-facing side, many loan origination systems (LOS) still depend on fragile, non-mainframe legacy technologies. It’s common to find:

- VB6/WinForms and Classic ASP powering back-office workflows.

- ASP.NET Web Forms and .NET Framework 2-4.x monoliths tied to WCF services.

- Java EE/Struts portals from the early 2000s.

- AngularJS 1.x front ends that reached end of life in 2021.

- SSIS/DataStage ETL pipelines, brittle from deprecated connectors.

- Crystal Reports and Excel/VBA adjuncts driving disclosures and reconciliations.

The risks are immediate: Web Forms are not supported on .NET 5+, AngularJS is obsolete, WCF requires CoreWCF bridges before moving to REST, and ETL dependencies break as vendors deprecate legacy connectors.

As these platforms remain in production year after year, the risk profile grows, whether due to security vulnerabilities, talent scarcity, or escalating maintenance costs.

If you’d like a complete perspective across major enterprise stacks, explore our pillar guides on .NET migration and Java migration.

Key Origination Journeys to Modernize

Loan origination modernization is an exercise that plays out in specific workflows that directly affect compliance, efficiency, and customer experience. Four journeys consistently surface as high-impact priorities:

1. Retail Onboarding & KYC

- Legacy: Web Forms portals, VB6/WinForms back-office screens, WCF-based identity checks, SSIS nightly syncs.

- Modern: ASP.NET Core or React UIs, API-first KYC orchestration, event-driven pipelines, parity testing for Reg B adverse action triggers.

2. Credit Decisioning & Pricing (Retail/Auto)

- Legacy: Business rules buried in .NET/Java monoliths; VB6 calculators; Crystal Reports disclosures.

- Modern: Rules extracted into .NET 8 or Spring Boot services; explanation artifacts generated for adverse action compliance; automated regression tests based on historical loan decisions.

3. SME Loan Origination (Section 1071 Reporting)

- Legacy: CSV-based ETL jobs (SSIS/DataStage), manual reconciliations.

- Modern: Schema-validated event pipelines, APIs aligned to Section 1071 fields, automated regulatory extracts.

4. Auto Lending Docs & Disclosures

- Legacy: Thick-client document prep, Crystal Reports/SSRS outputs, file drops to dealers.

- Modern: API-driven doc generation, output-diff testing for Truth-in-Lending disclosures.

Architectural Wrap-Up

Across these journeys, the modernization blueprint is consistent:

- Service Layer: .NET 8 or Spring Boot, bridging SOAP through CoreWCF before migrating to REST/gRPC.

- UI: Replace Web Forms and AngularJS with Blazor or React.

- Data: Shift to event-driven ETL with schema validation, observability, and audit logs.

Legacyleap’s LOS Gen AI Modernization Method

Traditional LOS modernization often fails because compliance requirements aren’t embedded into the process. Legacyleap takes a parity-first approach, ensuring that every modernized module behaves exactly like its legacy counterpart, while layering in compliance artifacts and risk controls from the start.

Here’s how the lifecycle works for loan origination systems:

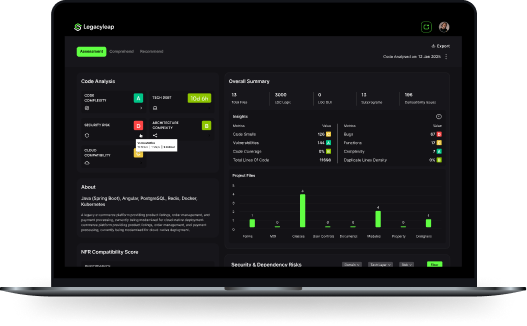

Phase 1: Comprehension & Assessment

- Auto-documentation: Generates technical and functional documentation for workflows, APIs, and business rules.

- Dependency mapping: Surfaces relationships across VB6/WinForms, Web Forms, Java EE, SSIS pipelines, and disclosure/reporting engines.

- Compliance overlay: Identifies touchpoints for Reg B adverse action notices and Section 1071 reporting within origination flows.

Output: A system-wide map of dependencies and compliance risks, even where no legacy documentation exists.

Phase 2: Recommendation

- Target-state mapping: Suggests modernization paths, e.g.:

- VB6 → .NET 8

- Java EE/Struts → Spring Boot

- Web Forms → Blazor/React

- SSIS/DataStage → Event-driven Spark pipelines

- VB6 → .NET 8

- Decision framework: Flags deprecated libraries, proposes replacements, and defines whether modules should be refactored, re-platformed, or rebuilt.

Output: A modernization feasibility plan aligned with compliance obligations and operational goals.

Phase 3: Transformation

- Compiler-backed translation: Code is rewritten using ASTs, MLIR, and compiler guardrails, not just GenAI predictions.

- Business rule extraction: Credit/pricing rules are pulled into modular services with separation from presentation layers.

- Automation: Up to 70% of code transformation handled automatically, reducing manual effort by 60-80%.

Output: Modernized codebase with clean separation of concerns, ready for compliance validation.

Phase 4: Validation

- Functional parity tests: Auto-generated test suites benchmark the new LOS against legacy behavior.

- Compliance validation: Automated tests ensure Reg B adverse action notices and Section 1071 reporting fields remain accurate.

- Parallel run mode: Legacy and modernized decisioning/disclosure workflows run side by side with diff reporting.

Output: Audit-ready assurance that the modernized LOS meets both business and regulatory requirements.

Phase 5: Deployment

- Cutover strategies: Supports strangler, blue/green, and canary deployments.

- Rollback options: Maintains safe fallback to legacy systems during migration.

- Deployment artifacts: Auto-generates Helm charts, Dockerfiles, and Terraform scripts for cloud readiness.

Output: Controlled rollout with rollback assurance, reducing go-live risk.

What You Get with Parity-First LOS Modernization

- Origination workflows modernized with compliance built in.

- 70%+ automation across transformation and testing.

- 60-80% reduction in manual effort.

- 40-50% faster project timelines (2-4 months vs. 6-12).

- Audit-ready validation aligned to Reg B and Section 1071.

Start with a $0 LOS Assessment

Modernizing a loan origination system is a process you can validate up front. In just 2-3 weeks, our $0 assessment gives you concrete deliverables that eliminate guesswork and de-risk your next move.

What you get:

- Origination blueprint covering retail, SME, and auto flows.

- Compliance mapping aligned to Section 1071 fields and Reg B adverse action explainability.

- Modernization feasibility plan across UI, service, and ETL layers.

- Parity test plan for adjudication, pricing, and disclosure workflows.

- Risk register + rollout roadmap showing sequencing, cutover strategies, and fallback options.

- Pilot outcome: One origination module modernized with measured parity metrics.

Why it matters now:

- Section 1071 compliance deadlines are already phasing in.

- Adverse action explainability under Reg B is a regulatory flashpoint.

- Fraud pressure and digitization gaps are driving immediate scrutiny from boards and regulators.

- LOS operating costs keep climbing—delays only compound margin pressure.

With Legacyleap’s Gen AI-powered, compliance-mapped modernization, you move forward with confidence: faster timelines, built-in safety nets, and proof of value from day one.

Start with your $0 LOS Assessment today for a low-risk, high-clarity first step toward a modern, compliant, and future-ready origination platform.

📘 Not ready to start yet? Learn more about what the $0 assessment includes in our dedicated blog, where we break down the full deliverables and process in detail.

FAQs

Q1. How do we integrate fintech partners or open banking APIs after modernization?

Modern API-first LOS architectures make it easier to plug in third-party APIs for income verification, fraud detection, and open banking without brittle file-based integrations.

Q2. What’s the impact on underwriting models and credit policy rules?

Existing rules are automatically documented and validated against historical loan decisions, ensuring credit policy consistency and auditability throughout the modernization process.

Q3. Can we roll out modernization selectively for retail, SME, or auto lending?

Yes. LOS modernization can be phased line by line before scaling across retail and auto products. For example, starting with SME lending to meet Section 1071 requirements.

Q4. How does Legacyleap ensure ECOA/Reg B adverse action explainability?

Legacyleap’s parity-first method generates explainability artifacts from historical decision data, preserving reason codes so lenders can meet the CFPB’s “specific reasons” requirement.

Q5. Is Section 1071 optional for SME loan origination?

No. Section 1071 is mandatory for institutions above CFPB thresholds, with phased compliance deadlines through 2027. LOS platforms must be upgraded to capture and report the required fields.