Introduction: Why Issuer Systems Face Their Most Urgent Modernization Window

For card issuer systems in the BFSI industry, regulatory deadlines are converging with long-standing technology debt, creating an environment where even modular systems like rewards and disputes are under the microscope.

In the US, 94% of financial institutions report that payments modernization efforts are either planned or already underway, yet many still depend on outdated architectures that make compliance and agility harder to achieve.

At the same time, PCI DSS v4.0’s future-dated requirements took effect on March 31, 2025, bringing stricter expectations for authentication, monitoring, and change controls in any component that touches cardholder data.

Against this backdrop, issuers running on legacy stacks (VB6, Web Forms, Java EE, WCF, and others) are finding it increasingly difficult to keep pace.

This blog will focus on how rewards, disputes, and tokenization systems can be modernized safely and efficiently, and how new approaches like Gen AI-accelerated modernization workflows and phased rollouts change what’s possible.

Legacy Landscape in Rewards & Disputes

Most issuer rewards and dispute systems still run on outdated frameworks that are no longer supported or secure.

- Case management tools often sit in VB6 or WinForms.

- Portals are built on Classic ASP and Web Forms.

- Business logic is buried inside .NET Framework/WCF services or Java EE/EJB/Struts monoliths.

- Even the front end often lingers on AngularJS 1.x, with batch jobs handled by SSIS or DataStage, and reporting dependent on Crystal Reports.

The risks are well-documented:

- Web Forms is not supported in .NET Core and beyond, making future upgrades impossible.

- AngularJS 1.x reached end-of-life in 2021, leaving security gaps unpatched.

- WCF services require a CoreWCF bridge just to maintain SOAP continuity.

For issuers still running these environments, the technology clock is ticking. Beyond limiting agility, these stacks make compliance with PCI DSS 4.0 and dispute resolution rules increasingly harder to sustain.

If you’d like a complete perspective across major enterprise stacks, explore our pillar guides on .NET migration and Java migration.

Issuer Journeys That Need Modernization First

While the technology footprint explains why issuers are under pressure, the bigger question is where to begin. Not every component of an issuer’s stack needs immediate replacement, but rewards, disputes, and tokenization consistently surface as the highest-impact entry points.

These workflows are modular enough to modernize without touching the core ledger, yet critical enough to expose compliance gaps and customer-experience risks if left behind.

1. Rewards & Loyalty Modernization

- Legacy: Accrual and burn rules often buried deep inside .NET or Java monoliths, exposed through Web Forms portals, with partner exports running through SSIS jobs.

- Modern: Rules modularized into .NET 8 or Spring Boot services, exposed via partner APIs and event-driven accrual flows. UIs rebuilt in Blazor or React, with parity tests validating historical balances to ensure no loyalty points are lost in transition.

2. Disputes & Chargebacks Modernization

- Legacy: Case management tools built on WinForms, portals on Web Forms, and network evidence exchanges still file-based.

- Modern: API-first case systems that embed Reg Z and Reg E timers directly into workflows. Support for CE 3.0 evidence ingestion, with workflow audit logs for compliance. CoreWCF bridges preserve SOAP continuity during cutover.

3. Tokenization & Digital Card Lifecycle

- Legacy: PAN-centric .NET Framework services, with manual provisioning of digital wallets and fragmented re-issuance processes.

- Modern: EMVCo-based tokenization APIs, integration with Visa Token Service, and event-driven lifecycle management. Observability ensures issuers track and act on re-issuance events in real time.

Architecture Wrap-Up

- Service layer: .NET 8 / Spring Boot, with SOAP continuity via CoreWCF.

- UI: Web Forms / AngularJS → Blazor, React, or Angular.

- Data: Batch ETL → event pipelines, with observability tied directly to PCI scope and dispute SLAs.

Gen AI-Driven Issuer Software Modernization Lifecycle

Issuer modernization isn’t about rewriting code and hoping it works. It’s about building certainty at every stage. Capturing the business logic inside loyalty rules, dispute workflows, and tokenization states, and carrying them forward into modern architectures with functional parity guaranteed.

Legacyleap’s lifecycle ensures exactly that:

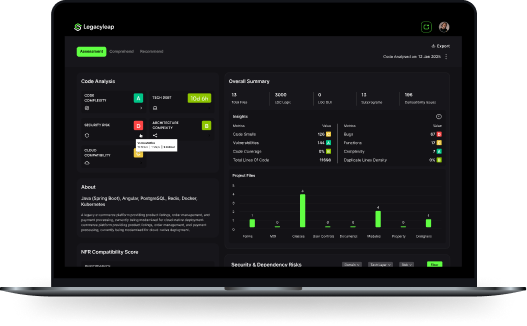

Phase 1: Comprehension & Assessment

- System documentation: Auto-generates business and technical documentation for rewards accrual rules, dispute workflows, and tokenization states.

- Dependency mapping: Identifies connections across VB6, Web Forms, Java EE, WCF, SSIS/DataStage, and reporting tools like Crystal Reports.

- Compliance scan: Highlights where PCI DSS 4.0 controls, Reg Z/E dispute timers, and Visa CE 3.0 evidence standards apply.

Output: A detailed system and compliance map of issuer workflows.

Phase 2: Recommendation

- Target-state mapping: Defines modernization paths such as:

- VB6 → .NET 8

- Java EE/Struts → Spring Boot

- Crystal Reports → API-driven reporting

- VB6 → .NET 8

- Decision framework: Flags deprecated libraries, recommends replacements, and defines whether modules should be refactored, re-platformed, or rebuilt.

Output: A modernization feasibility plan aligned with both compliance and operational goals.

Phase 3: Transformation

- Compiler-backed translation: Code is rewritten using ASTs, MLIR, and compiler guardrails, not just Gen AI predictions.

- Business rule extraction: Embedded rules (e.g., escrow logic, loyalty accruals) are separated from presentation layers and pulled into modular services.

- Automation: Up to 70% of code transformation handled automatically, cutting manual effort by 60-80%.

Output: Clean, modular codebases ready for functional validation.

Phase 4: Validation

- Parity-first testing: Auto-generates unit, API, and workflow tests to prove functional equivalence.

- Compliance timers: Builds Reg Z 30/90-day clocks and Reg E 10/45-day timers into test cases.

- CE 3.0 validation: Ensures evidence payloads meet updated Visa requirements.

- PCI DSS 4.0 controls: Verifies stronger auth, monitoring, and change controls are embedded.

Output: A validated system with compliance-aligned safety nets.

Phase 5: Deployment

- Artifacts: Generates Helm charts, Dockerfiles, and Terraform scripts for production rollout.

- Rollout strategies: Supports strangler migration for rewards, blue/green deployments for disputes, and canary releases for tokenization endpoints.

- Observability: Enables monitoring tied to PCI scope and issuer dispute SLAs.

Output: Production-ready issuer software modernization with rollback and monitoring safeguards.

Start with a $0 Issuer Software Assessment

Before tackling modernization at scale, issuers can start small by validating feasibility, compliance, and parity in just a few weeks. Our $0 assessment is designed to deliver concrete, audit-ready outputs without risk or obligation:

- Rewards map: Documentation of accrual/burn rules, partner API dependencies, and historical balances.

- Disputes map: Evidence intake workflows, SLA timers tied to Reg Z/Reg E, and CE 3.0 compliance checkpoints.

- Tokenization map: Lifecycle flows, provisioning logic, and re-issuance triggers.

- Modernization feasibility plan: UI, services, and pipelines mapped to target stacks.

- Parity test plan: Validation strategies covering balances, CE 3.0 payloads, and dispute timelines.

With these deliverables in hand, issuers can move directly into a low-risk pilot, modernizing either the rewards accrual service or disputes case intake first.

The safest way forward is to start now is with a no-cost assessment that gives issuers clarity, confidence, and a pilot-ready plan.

Start your $0 Issuer Software Assessment today. Define the scope (rewards or disputes first) and see how Gen AI-driven modernization can deliver compliance, parity, and faster timelines with zero upfront risk.

📘 Not ready to start yet? Learn more about what the $0 assessment includes in our dedicated blog, where we break down the full deliverables and process in detail.

FAQs

PCI DSS 4.0 introduces stricter authentication, anti-phishing, and change-control requirements. Older rewards and disputes modules rarely meet these standards without modernization.

Modernized systems expose standardized APIs, enabling issuers to seamlessly handle CE 3.0 evidence submissions, 3DS authentications, and tokenization updates across networks.

Yes. Legacyleap’s parity-first migration validates historical balances, accruals, and redemptions to ensure customer entitlements remain intact during the transition.

By supporting CE 3.0 evidence payloads and EMV 3DS risk data, issuers can strengthen dispute cases, improve win rates, and reduce chargeback write-offs.

Gen AI-driven automation in Legacyleap creates compliance-ready artifacts: timers for Reg Z/E dispute clocks, PCI DSS 4.0 control checks, and CE 3.0 data validations, all audit-ready by design.