Introduction: Compliance Deadlines on Outdated Systems

Mortgage servicers and escrow software are entering a critical window. In July 2024, the CFPB proposed new rules tightening foreclosure safeguards and requiring faster borrower assistance (CFPB). The Bureau’s 2023-24 Supervisory Highlights continue to flag fee errors, missed notices, and transfer failures, issues directly tied to weak servicing infrastructure.

At the same time, borrowers expect seamless digital servicing. The J.D. Power 2024 Servicer Satisfaction Study ranked “ease of doing business” as the top driver, even as only 41% of borrowers remain financially healthy, down from 46% in 2023.

The challenge? Most escrow and servicing systems still run on VB6 calculators, Web Forms portals, Java EE screens, and Crystal Reports, stacks that are long past support. These systems weren’t designed for RESPA Reg X §1024.17 obligations: annual escrow analysis, strict disbursement deadlines, and timely statement delivery.

This blog outlines how Gen AI-enabled modernization offers a safe path forward, aligning outdated servicing systems with today’s compliance demands and borrower expectations.

Legacy Footprint in Servicing/Escrow: Where the Risk Lives

Behind most mortgage servicing operations sit technology stacks that regulators no longer recognize as defensible. Core escrow logic, borrower statements, and transfer pipelines are still frequently tied to:

- VB6 and Classic ASP applications: The VB6 IDE was retired in 2008, and its runtime is supported only in “It just works” mode.

- ASP.NET Web Forms: Not supported in .NET 5+, leaving teams with no upgrade path.

- Java EE frameworks like Struts: Brittle monoliths with limited vendor support.

- AngularJS 1.x portals: Officially end-of-life since December 31, 2021.

- SSIS/DataStage ETL pipelines and Crystal Reports: Batch-heavy tools prone to errors and maintenance overhead.

These platforms are fragile. Scarcity of engineers skilled in VB6, Web Forms, or Struts raises operating costs and heightens the risk of disruption. In many servicing shops, escrow calculators, Crystal Reports-driven statements, and nightly ETL jobs still form the backbone of compliance workflows, patterns that introduce audit exposure and customer friction.

For mortgage servicers, the issue is no longer if these stacks will fail compliance, but when.

If you’d like a complete perspective across major enterprise stacks, explore our pillar guides on .NET migration and Java migration.

From Legacy Workflows to Modern Target States

Modernizing mortgage servicing software isn’t about abstract “digital transformation.” It’s about replacing brittle workflows with compliant, auditable systems mapped directly to RESPA Reg X §1024.17 obligations.

1. Reg X §1024.17(c),(f) – Escrow Analysis & Recomputation

- Legacy: Calculators and screens built on VB6, Web Forms, or Java EE, with results funneled through Crystal Reports or batch ETL jobs.

- Modern: Stateless services in .NET 8 or Spring Boot, with automated parity tests ensuring shortage/surplus calculations match legacy outcomes.

2. Reg X §1024.17(k) – Disbursement Deadlines

- Legacy: Windows Services, WCF schedulers, Java EE batch jobs prone to delays and missed penalty dates.

- Modern: Resilient background workers with CoreWCF for SOAP continuity, phased migration to REST/gRPC, and canary scheduling to meet deadline SLAs.

3. Reg X §1024.17(i) – Annual and Short-Year Statements

- Legacy: Crystal Reports or SSRS tied tightly to stored procedures, with limited audit trails.

- Modern: API-driven statement generation with diff testing to validate outputs against legacy reports before cutover.

4. Servicing Transfers

- Legacy: File-based transfers using SSIS/DataStage pipelines or custom .NET/Java mappers.

- Modern: Schema-validated adapters with idempotent replay and field-level diff checks to prove accuracy across transfers.

Architectural Summary

The modern target state converges on:

- API-first services in .NET 8 or Spring Boot.

- Modern UI frameworks (Blazor, React) replacing AngularJS portals.

- Event-driven data pipelines (Spark, Kafka) instead of nightly batch ETL.

- Observability and audit logging built in for CFPB exam readiness.

This is the standard regulators now expect and borrowers demand. Anything less risks non-compliance, audit exposure, and reputational damage.

Legacyleap Method: Parity-First Modernization

Legacy mortgage servicing systems can’t be modernized with “best effort” rewrites. Compliance requirements under RESPA Reg X §1024.17 demand certainty. Borrower escrow logic, disbursement timelines, and statement delivery must behave exactly as before.

Legacyleap achieves this with a parity-first model, structured across five defined phases.

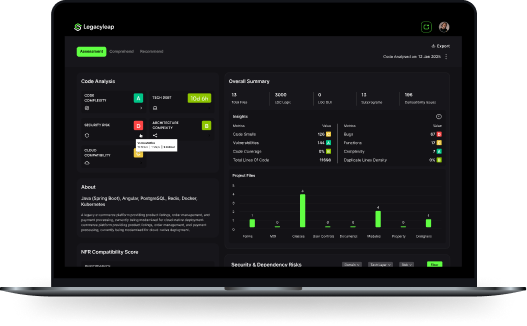

Phase 1: Comprehension & Assessment

- Deep system understanding: The platform ingests VB6, Web Forms, Java EE, and ETL codebases.

- Outputs:

- Escrow logic maps (shortage/surplus/deficiency rules).

- Dependency graphs from UI → services → ETL → reports.

- API documentation and call graphs.

- Escrow logic maps (shortage/surplus/deficiency rules).

This eliminates the “tribal knowledge” problem, which is critical since most servicing codebases lack up-to-date documentation. Legacyleap auto-generates the baseline needed for safe modernization.

Phase 2: Recommendation

- Target-state mapping: Identifies best-fit modernization paths such as:

- VB6 → .NET 8

- Java EE/Struts → Spring Boot

- Crystal Reports → API-driven reporting

- VB6 → .NET 8

- Decision framework: Flags deprecated libraries, recommends replacements, and defines whether modules should be refactored, re-platformed, or rebuilt.

Output: A modernization feasibility plan aligned with both compliance and operational goals.

Phase 3: Transformation

- Compiler-backed translation: Code is rewritten using ASTs, MLIR, and compiler guardrails, not just Gen AI predictions.

- Business rule extraction: Embedded escrow rules are pulled into modular services with clean separation from presentation layers.

- Automation: Up to 70% of code transformation handled automatically, cutting manual effort by 60-80%.

Phase 4: Validation

- Parity-first testing: Auto-generated unit, integration, and API tests mapped directly to Reg X clauses:

- §1024.17(c),(f) for escrow analysis/recomputation.

- §1024.17(k) for disbursement deadlines.

- §1024.17(i) for annual and short-year statements.

- §1024.17(c),(f) for escrow analysis/recomputation.

- Parallel runs: Legacy and modern outputs compared side by side, with field-level diff checks to prove accuracy.

Outcome: Functional parity demonstrated before go-live.

Phase 5: Deployment

- Controlled rollout: Strangler pattern for phased cutovers, blue/green deployments for clean transitions, and canary schedulers for disbursement processes.

- Audit readiness: Each deployment produces validation artifacts such as traceable logs, parity test reports, and compliance evidence.

- Enterprise fit: Runs securely inside client environments, meeting SOC 2 and CFPB exam standards.

What You Get with Parity-First Modernization

- Escrow logic preserved, documented, and validated.

- Compliance tests auto-mapped to Reg X obligations.

- 70%+ automation in code transformation.

- 40-50% faster project timelines than manual rewrites.

- Audit-ready artifacts regulators can review without ambiguity.

Start with a $0 Mortgage Servicing System Assessment

Modernization doesn’t have to start with a risky rewrite. The fastest way to prove feasibility is a focused $0 assessment that delivers measurable artifacts in just 2-3 weeks.

What you get:

- Escrow logic map covering shortage, surplus, and deficiency rules.

- Dependency graph tracing UI → services → ETL → reports.

- Modernization feasibility plan with recommended stack targets.

- Reg X-mapped parity test plan to validate compliance obligations.

- Risk register + rollout strategy for phased cutovers.

This provides a clear pilot scope (for example, the annual statement module) with defined success metrics before full-scale rollout.

For servicers under CFPB scrutiny and rising borrower expectations, this is a low-risk entry point: evidence-backed, compliance-mapped, and built around Legacyleap’s parity-first modernization model.

Start with a $0 mortgage servicing system assessment today, and see how escrow software modernization can move from legacy burden to exam-ready infrastructure.

📘 Not ready to start yet? Learn more about what the $0 assessment includes in our dedicated blog, where we break down the full deliverables and process in detail.

FAQs

Yes. A parity-modernization approach validates every escrow balance, shortage/surplus, and statement history with automated diff testing, ensuring nothing is lost in transition.

Yes. Modules such as statement generation or disbursement schedulers can run in parallel with legacy systems, so borrowers experience no interruptions during rollout.

Modernized systems use schema validation and idempotent replay to ensure all escrow balances, schedules, and obligations are transferred accurately and without drift.

Legacyleap’s Gen AI-powered platform generates automated test suites mapped to Reg X obligations (covering escrow analysis, disbursement deadlines, and statement timelines) so compliance is verifiable at every step.

Projects that traditionally spanned 6-12 months can often be completed in 2-4 months with Legacyleap, leveraging 70% automation and validated parity to reduce timelines without added risk.